Returns a value specifying the net present value of an investment

Returns a value specifying the net present value of an investment based on a series of periodic cash flows (payments and receipts) and a discount rate.

The net present value of an investment is the current value of a future series of payments and receipts.

The NPV function uses the order of values within the array to interpret the order of payments and receipts. Be sure to enter your payment and receipt values in the correct sequence.

The NPV investment begins one period before the date of the first cash flow value and ends with the last cash flow value in the array.

The net present value calculation is based on future cash flows. If your first cash flow occurs at the beginning of the first period, the first value must be added to the value returned by NPV and must not be included in the cash flow values of ValueArray.

The NPV function is similar to the PV function (present value) except that the PV function allows cash flows to begin either at the end or the beginning of a period. Unlike the variable NPV cash flow values, PV cash flows must be fixed throughout the investment.

|

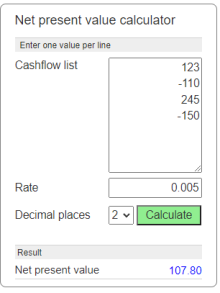

Rate

The discount rate over the length of the period, expressed as a decimal.

Cashflow list

Array specifying cash flow values. The array must contain at least one negative value (a payment) and one positive value (a receipt).

|

|