PPmt Function

Returns the principal payment for a given period

Description

The function PPmt returns a value specifying the principal payment for a given period of an annuity based on periodic fixed payments and a fixed interest rate.

Syntax

PPmt (Rate, Per, NPer, PV)

PPmt (Rate, Per, NPer, PV, FV)

PPmt (Rate, Per, NPer, PV, FV, Due)

Required Parameters

Rate

The interest rate per period. For example, if you get a car loan at an annual percentage rate (APR) of 10 percent and make monthly payments, the rate per period is 0.1/12, or 0.0083.

Per

Payment period for which the principal payment is to be calculated in the range from 1 through NPer.

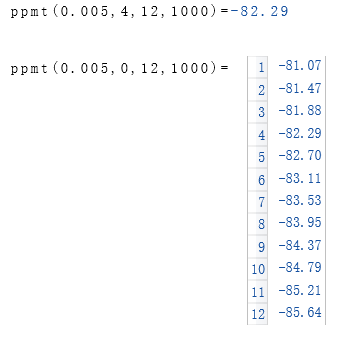

New from version 7.10:

If a zero is specified as Per, the result is a list containing the values of all periods.

NPer

The total number of payment periods in the annuity. For example, if you make monthly payments on a four-year car loan, your loan has a total of 4 x 12 (or 48) payment periods.

PV

The current value of a series of future payments or receipts. For example, when you borrow money to buy a car, the loan amount is the present value to the lender of the monthly car payments you will make.

Optional Parameters

FV

The future value or cash balance you want after you have made the final payment.

For example, the future value of a loan is $0 because that is its value after the final payment. However, if you want to save $50,000 over 18 years for your child's education, then $50,000 is the future value.

If omitted, 0 is assumed.

Due

Value that specifies when payments are due. This argument must be either 0 if payments are due at the end of the payment period, or 1 if payments are due at the beginning of the period.

If omitted, 0 is assumed.

Examples