DDB Function (double-declining balance)

The funtion returns the depreciation of an asset for a specific time period

Returns a value specifying the depreciation of an asset for a specific time period using the double-declining balance method or some other method you specify.

The double-declining balance method computes depreciation at an accelerated rate. Depreciation is highest in the first period and decreases in successive periods.

The declining balance depreciation method is an accelerated depreciation, the higher depreciation amounts in the first few years of the useful life of an asset and greater tax savings than the straight-line amortization method, where the amounts are always the same.

The Life and Period arguments must be expressed in the same units. For example, if Life is given in months, Period must also be given in months. All arguments must be positive numbers.

|

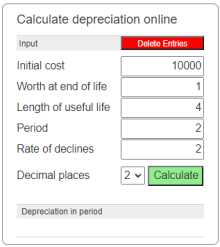

Example

Description of the parameters

Cost

The initial cost of the asset.

Worth

The value of the asset at the end of its useful life.

Life

The length of useful life of the asset.

Period

The period for which asset depreciation is calculated.

Rate

The rate at which the balance declines. The default is 2 (double-declining method).

|

|